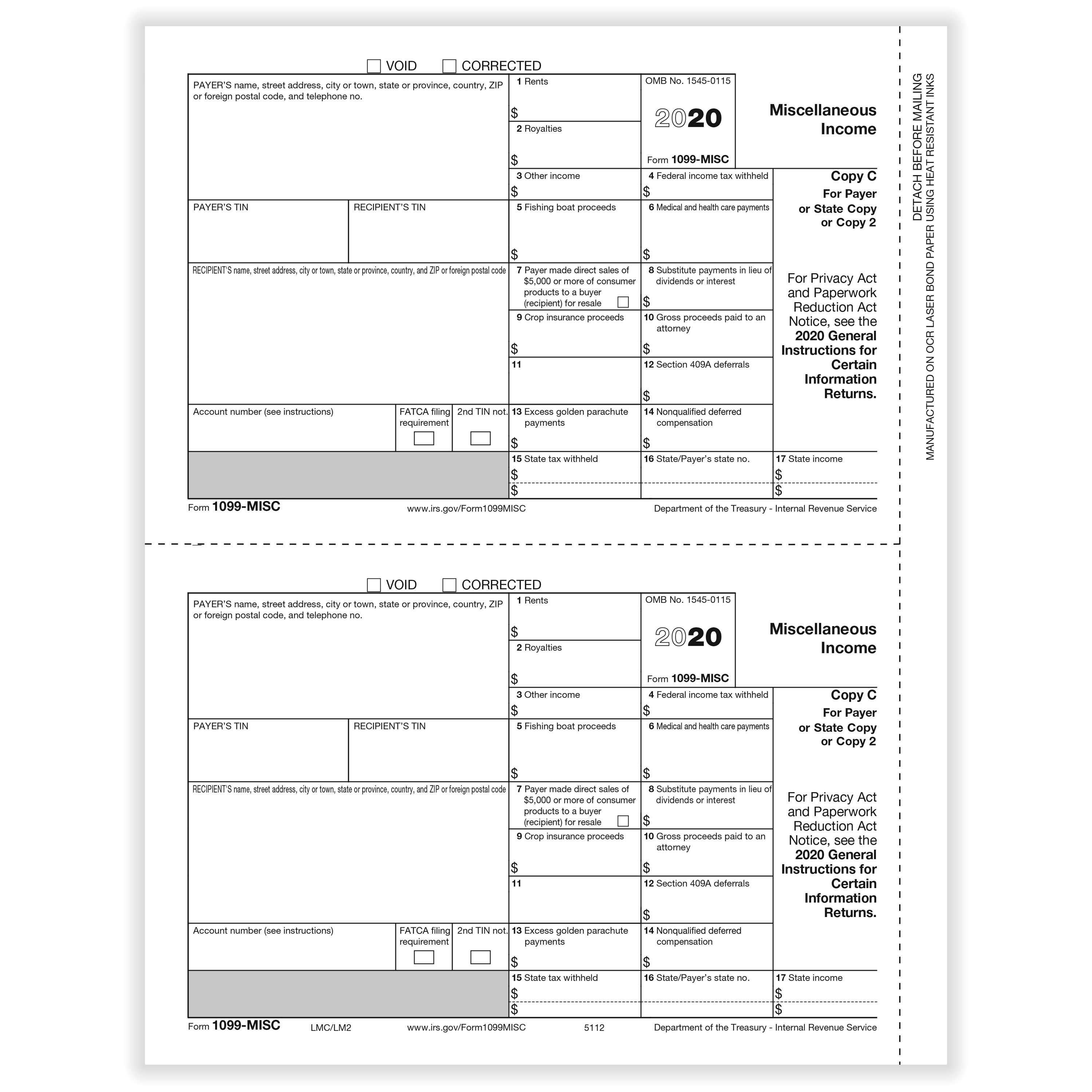

The purpose of Form 1099-MISC is to track and account for listed payments as a business deduction for business payers and income for payees. Tax experts say the new 1099-K conditions will be a bumpy ride at first, particularly because some taxpayers might get a 1099-NEC and a 1099-K for the same income. Since you likely paid fees to the payment processing platform in order to use their service, be sure to include these expenses in your deductions. A 1099 form is a tax statement you may receive from a bank, a broker, a business or another entity paying you nonemployee compensation throughout the year. There are several types of 1099 forms — which one(s) you receive will depend on the type of income earned.

Form 1099-H instructions

- Brokers must submit a 1099-B to each individual to report gains or losses from transactions.

- We believe everyone should be able to make financial decisions with confidence.

- Here’s how the 1099-MISC, titled “Miscellaneous Information,” works.

The phrase “1099 employee” generally describes a person who, in the eyes of the IRS, is an independent contractor, also called self-employed or a freelancer. People who are considered 1099 workers are generally asked to fill out a W-9 at the start of a new work relationship or contract. In 2020, the IRS reintroduced the 1099-NEC, which companies now use to report money paid to people who did work for them but weren’t employees.

Credits & Deductions

TurboTax will ask simple questions about you and help you easily file your taxes. If you’re self employed, TurboTax now has TurboTax Self-Employed that helps you uncover deductible business expenses that you didn’t even know existed. It is worth noting, though, that not everyone in this situation will be hit with the new paperwork. If your total payment transactions are less than $20,000, and there are less than 200 transactions, they won’t have to be reported on the 1099-K. Technically, you should be reporting the income anyway, but this move is meant to help better enforce it.

What is a 1099? Types, details, and how to pay contractors

Beginning in the 2020 tax year, Form 1099-NEC will be used to report non-employee compensation, one of the most common uses of the 1099. Form 1099 is also used to report interest (1099-INT), dividends (1099-DIV), sales proceeds (1099-B) and some kinds of miscellaneous income (1099-MISC). Blank 1099 forms and the related instructions can be downloaded from the IRS website. Although you don’t need to know much about tax forms with TurboTax on your side, it’s always best to organize your forms that when you sit down to do your taxes.

SA: Distributions From an HSA, Archer MSA or Medicare Advantage MSA

Also, realize that payment processors and other 1099-K reporters won’t subtract out charge-backs and fees – they only report gross receipts. Small businesses and individuals can still barter for goods and services. Trades often go through a third party called a barter exchange, which acts as a bank and facilitates bartering among multiple entities. The first and most common use is to report capital gains (or losses) from the sale of stocks, bonds, securities, and property handled by a broker.

For tax years when the form was still relevant, TaxAct made it easy to report health coverage tax credit information. The 1099-H form was an Internal Revenue Service (IRS) form that reported the total amount of advance payments received for the health coverage tax credit. On the other hand, a non-accountable plan does not meet the requirements of an accountable plan.

Purchasing a house is now the most common reason for receiving a 1099-MISC, according to Pino, since you’ll have one-time property tax and mortgage-interest deductions. The 1099-Q reports money that you, your child, or your child’s school receive from a 529 plan. Keep in mind, however, that the earnings in a 529 plan are generally not subject to tax when they’re used for qualified education expenses, so for many people, the 1099-Q is just record-keeping.

Remember, even if you don’t receive a 1099, you still need to report that income, so keeping good financial records throughout the year is important. There are exceptions with each type of 1099 form, and not all payments are required to be reported to the IRS by the payer. For example, payments under $600 to an individual will not need 1099-NEC reporting, even though the payee must still report that income on their personal return. Each form has its own thresholds what are 1099s and exceptions, so it is best to talk to a tax preparer in order to understand your obligations. Vendors or subcontractors, such as individuals, partnerships, or LLCs, that have been paid at least $600 for their services must receive Form 1099-NEC, Nonemployee Compensation. However, while there are some exceptions, like payments to an attorney, you typically don’t have to issue 1099-NEC forms to C corps and S corps (or LLCs that are registered as such).

Personal payments like this are typically not considered as taxable income and should not be reported on your tax return. Keep these transactions on a personal account to avoid potential issues. The IRS matches a payee’s tax returns with received 1099s to discover any unreported or under-reported income on which self-employment tax payment is required.