In the company as a corporation, we may issue the common stock for cash for expanding the business operation. Likewise, we need to make the journal entry for issuing the common stock in order leveraged loan funds to account for the increase in the capital section of the equity on the balance sheet. The number of issued shares is simply the quantity that has been sold or otherwise conveyed to owners.

Understanding Stockholders’ Equity

In particular, dealing with shares, or common stock, can be daunting for the accounting student and small business owner alike. You have par values, share premiums, applications, allotments, calls and all sorts of things that can go on. So there is a complication to deal with, but with our comprehensive guide, preparing a journal entry for issue of common stock is very straightforward. Hence, we may come across the circumstance in which the common stock has no par value (e.i., no par value registered on the stock certificate). In this case, when we issue the common stock, we will need to record the entire amount of cash received to the common stock account without additional paid-in capital involved.

Please Sign in to set this content as a favorite.

Recording common stock issued is an important part of managing your business’s finances. The first step in recording common stock issued is to identify the date of issuance and the number of shares issued. Once this has been identified, you can begin recording your journal entry.

Issuing Common Stock with a Par Value in Exchange for Cash

A purchase can also create demand for the stock, which inturn raises the market price of the stock. Sometimes companies buyback shares to be used for employee stock options or profit-sharingplans. However, other sources of finance or equity do not have the same effect. On top of that, the accounting for the issuance of common stock differs from other sources. This accounting treatment also differentiates this finance source on the balance sheet. Before understanding the accounting for the allotment of common stock, it is crucial to know what it is.

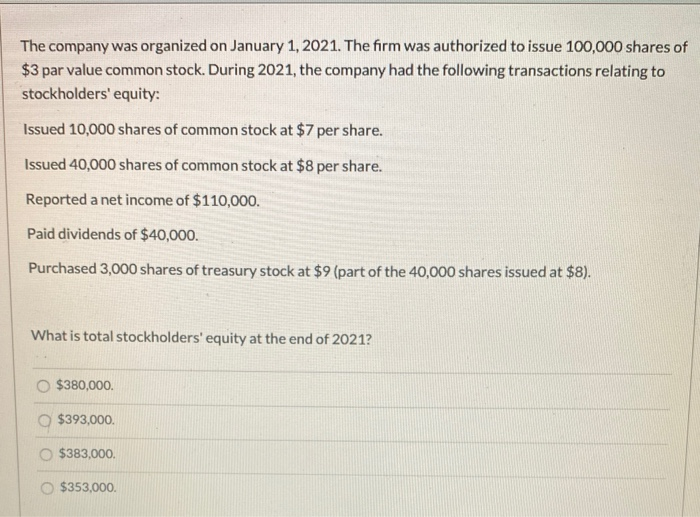

Stock Dividends Journal Entries

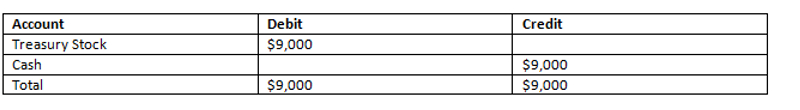

The difference is recorded as a credit of$300 to Additional Paid-in Capital from Treasury Stock. When a company issues new stock for cash, assets increase with adebit, and equity accounts increase with a credit. To illustrate,assume that La Cantina issues 8,000 shares of common stock toinvestors on January 1 for cash, with the investors paying cash of$21.50 per share. When par value stock is issued at a premium, the assets received both cash or noncash assets are higher than the value of the common stock. For example, a cash receipt of $12 per share for common stock of $10 par value. The excess of $2 ($12 minus $10) is called a premium or capital contribution in excess of par value.

Issuing Common Stock with a Par Value in Exchange for Property

- So, the fair value of the shares of the common stock given up will be used as the measurement if its market value is available.

- Therefore, the common stock does not come with guaranteed distributions.

- In accounting, this term describes the total finance received from a company’s shareholders over the years.

- This time Preferred Stock and Paid-in Capital in Excess of Par – Preferred Stock are credited instead of the accounts for common stock.

It is the lowest amount that the company can sell the stock for. The difference between issuance price and par value is recorded as Additional Paid-In Capital. 1Although the Kellogg Company has its headquarters in Battle Creek, Michigan, the company is incorporated in the state of Delaware. Thus, the laws of Delaware set the rights of the common stock shares for this company. After buying back Kevin’s shares, ABC decides to retire the shares on July 31.

When a company gets incorporated, it must decide this par value. However, this value does not represent the finance that the company receives for underlying shares. The second feature that differentiates common stock from others is voting rights.

Common stockholder will receive dividend when the company making good profit with the approval from board of director. Besides the dividend, the common shareholders can gain from the investment when the share price increase. They will be entitled to receive company assets in the event of liquidation after all creditors are settled.

A stock dividend is when a company distributes additional shares to existing shareholders. Stock dividends are classified as either small (typically less than 20-25% of outstanding shares) or large (more than 20-25% of outstanding shares). Company can raise money to expand the business and continue operation by issuing common stock to the investors. A group of investors is not able to raise enough money to operate business in a big scale, so they need to raise more capital from the market with thousands of investors. No par value stock is the share that issue to the market without stating its par value on the certificate. When the share has no par value, all the issuance prices will be recorded into the common stock.

Common Stock or Common Share is the company equity instrument that represents corporation ownership. The company listed on the stock exchange and sell the ownership to the investors to raise the capital. The company wants to raise cash to pay off debt, expand the operation, acquire other company and support daily activities. 4As mentioned in the previous chapter, the sales of capital stock that occur on the New York Stock Exchange or other stock markets are between investors and have no direct effect on the company. In the example below, we will look at when this transaction takes place and how to issue stock above par value. As a quick refresh, par value is the face-value or legally issued price of the share.