Shares with a par value of $5 have traded (sold) in the market for more than $600, and many $100 par value preferred stocks have traded for considerably less than par. This total reflects the assets conveyed to the business in exchange for capital stock. For Kellogg, that figure is $1,173 million, the amount received from its owners since operations first began. For Kellogg, that figure is $543 million, the amount received from its owners since operations first began. Even though the difference—the selling price less thecost—looks like a gain, it is treated as additional capital becausegains and losses only result from the disposition of economicresources (assets). Assume that onAugust 1, La Cantina sells another 100 shares of its treasurystock, but this time the selling price is $28 per share.

Issuance of Common Stock Journal Entry

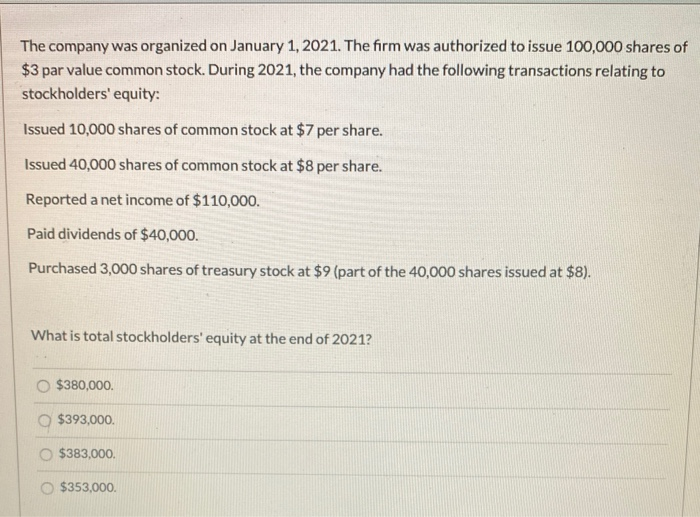

If it wishes to issue more shares than the number authorized, it may approach the Board of Directors with this request. A journal entry must be recorded when a corporation issues stock. For large stock dividends, retained earnings are debited only at the par value of the shares being issued. Figure 14.5 shows what the equity section of the balance sheetwill reflect after the preferred stock is issued. The number of shares outstanding always equal to or less than the number of shares issued.

Accounting for Common Stock

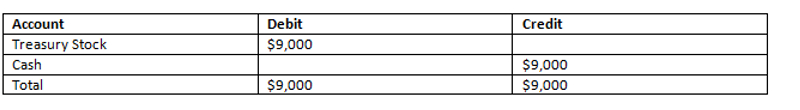

The company needs to reverse the treasury stock with common stock and additional paid-in capital. The company can retire stock by buyback the outstanding stock from the market. So it means they need to record the common stock to treasury stock before retiring the stock. Retained earnings will be recorded if the additional Paid-in-Capital balance is lower than the difference between cash receive and treasury stock balance. Overall, the journal entries for the issuance of common stock will be as follows.

Journal Entry For Issue of Common Stock – Your Comprehensive Guide

Understanding these entries helps clarify how each type of transaction affects a company’s financial statements and equity structure. The company usually sets an authorized share higher than their current need. Management may decide to retire treasury stock in balance sheet. The company is able to sell the stock back at a higher price when it buyback. So the company needs to record more additional paid-in-capital into the balance sheet. The company will be liable to the shareholders in case of the market price fall below par value.

If there isno balance in the Additional Paid-in Capital from Treasury Stockaccount, the entire debit will reduce retained earnings. Notice on the partial balance sheet that the number of commonshares outstanding changes when treasury stock transactions occur.Initially, the company had 10,000 common shares issued andoutstanding. The 800 repurchased shares are no longer outstanding,reducing the total outstanding to 9,200 shares. The company charges $150 per share for this issuance, making the overall finance received $150,000. However, the par value of those shares is $100, making the total par value of those shares $100,000.

Common shares without par value are journalized by debiting cash (asset) for the amount received for the shares and crediting common shares (equity) for the same amount. When a company issues new common shares from treasury, it means that the company is creating and selling new shares that have not previously been outstanding. Treasury shares are authorized but not currently owned by anyone, so they are effectively “new” shares that the company is creating and selling to raise capital.

- Shares issued is the number of shares a corporation has sold to stockholders for the first time.

- There are three types of transactions you will need to know when preparing a journal entry for common stock.

- The credit to the share capital account and the additional paid-in capital reflects where is money is coming from, i.e. from people investing equity into the company.

- The line items used for its reporting in the statement of cash flows are “issuance of common stock,” if the common shares are sold, and “issuance of preferred stock,” if the preferred shares are sold.

- The debit to the bank account reflects the $400,000 ABC now has from its first call on the class A shares.

According to The MotleyFool, the Walt DisneyCompany bought back 74 million shares in 2016alone. Read the Motley Foolarticle and comment on other options that WaltDisney may have had to obtain financing. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. The first debit entry takes the $400,000 in application money out of the application account. If then splits this across the Class A Share Capital account, being the allotted money. Then theClass A Additional Paid-in Capital account, as we calculated above.

These voting rights allow the shareholders to dictate how the company operates. For example, they can elect the board of directors and vote on a company’s policies. However, the same rights are not a part of the other types of stock that companies offer, for instance, preferred stock. Some of these terms have been examined previously, others have not.

You will hear the words “stock market” and “share market” used interchangeably. This journal entry will reduce the balance of the retained earnings by the different amount of market value and the par value of the common stock. And of course, the difference here is the result of the market value being lower than the par value, not the other way around. The measurement of the fair value of the service in the case of issuing the common stock for the services is the same as above.

And to balance the accounting equation, we see the removal of the treasury stock from the asset side. In accounting, when the company issues the common stock, its price will be used to compare with the par value or stated value of such stock before the journal entry is made. The $5,000 of the common stock account in the journal entry comes from the 5,000 shares multiplying with the $1 per share of the par value. And the $45,000 of the additional paid-in capital comes from the $50,000 amount which is the total market value of shares of common stock given up deducting the $5,000. The journal entry for issuing the common stock for cash will increase both total assets and total equity on the balance sheet.

Thecorporate charter of the corporation indicates that the par valueof its common stock is $1.50 per share. When stock is sold toinvestors, it is very rarely sold at par value. Stock with no par value that has beenassigned a reconciliation stated value is treated very similarly to stock with apar value. Keep in mind your journal entry must always balance (total debits must equal total credits). Watch this video to demonstrate par and no-par value transactions.