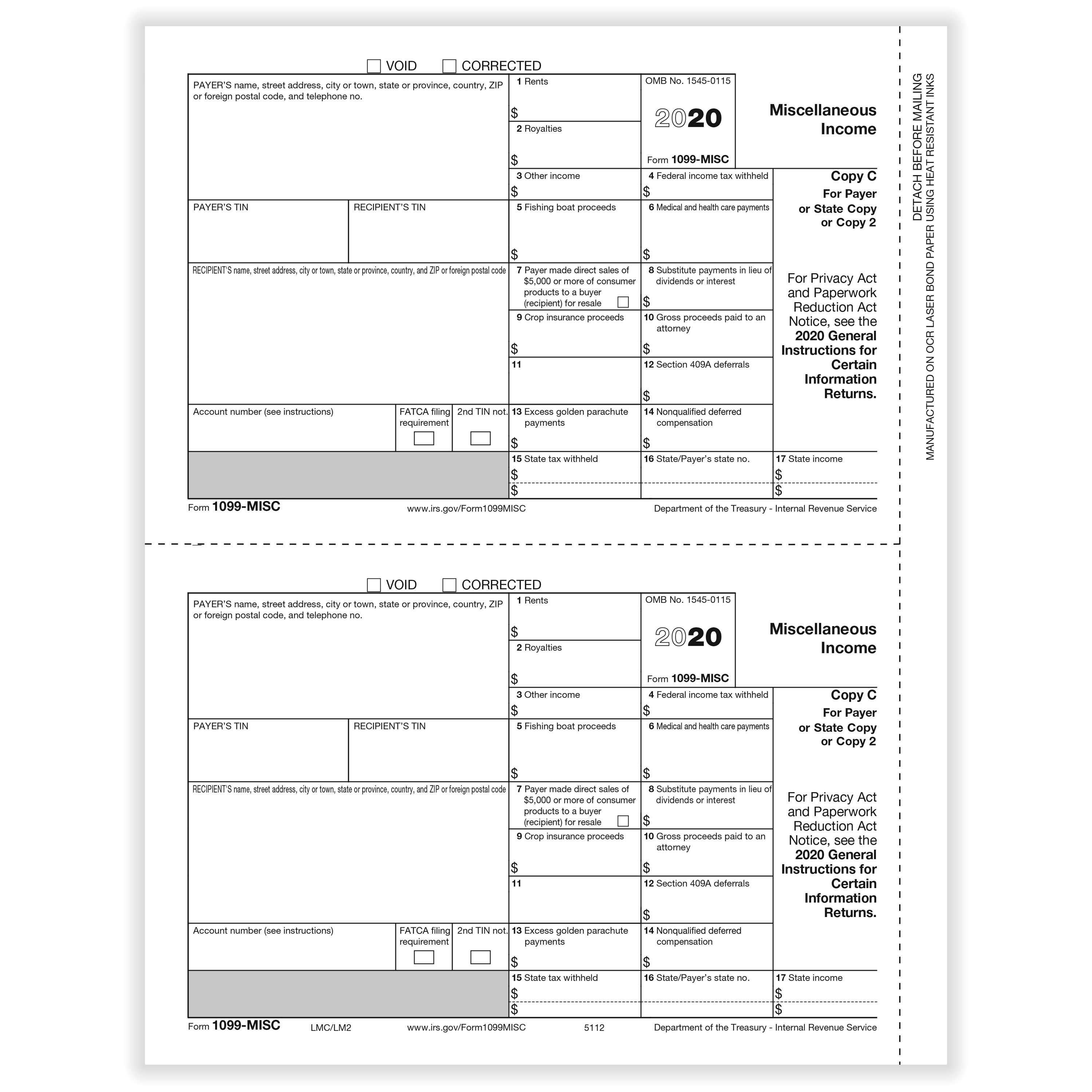

Think contributions to Coverdell Education Savings Accounts or 529 plans that were made on your behalf. You’ll receive this 1099 if you’re the plan’s designated beneficiary. Form 1099 is a type of tax form that records payments received that don’t come from salary or wages. You should receive this form if you worked for someone as an independent contractor.

Self-Employment Tax: What It Is, How to Calculate It

Form 1099-H was last used for tax year 2021 and was issued to people who received advance payments of the health coverage tax credit (HCTC) to help cover health insurance costs. Let’s break down exactly what this what are 1099s form was all about and how it impacted your income tax return. Whether reimbursed travel expenses are reported on a 1099-MISC depends on whether the expense reimbursements are paid under an accountable plan.

Podcast: Can I Deduct That? Tax Tricks for Influencers

Lenders typically use this form after transferring a property due to foreclosure. All types of 1099s apply to businesses, but the most commonly used 1099 forms are 1099-MISC, 1099-NEC, 1099-R, and 1099-S. Anyone who transfers life insurance to someone else must file Form 1099-SB to report the sale of the said life insurance policy. If your property was foreclosed and the lender canceled some or all of your mortgage in the last tax year, you’ll most likely receive Form 1099-A. All 1099s are required to be sent out to recipients by Jan. 31 of each calendar year.

Reimbursements for travel expenses are included on a 1099 MISC

The main difference between the two forms boils down to your relationship with the payer. You use your IRS Form 1099 to figure out how much income you received during the year and what kind of income it was. You’ll report that income in different places on your tax return, depending on the type of income. You’ll typically receive a 1099 by the end of January or early February in the year following when the income was earned because you’ll need to refer to it when filling out your annual tax return. Try to explain it on your tax return if you can’t convince your insurance company to cancel the 1099. One possibility is to include a zero with a “see note” on line 7a, the “other income” line of a 1040 form, which is then reported on line 8 of Schedule 1.

What are some of the most common types of 1099 Forms?

It also covers rents paid and prizes won, and it reports a number of agricultural and fishing transactions as well. The 1099-NEC form should include payments made to you if they are $600 or more from a single source or if any federal tax was withheld. If you receive a 1099 form, it’s your responsibility to report the income earned on your tax return. When you receive a 1099, it doesn’t necessarily mean you have to pay taxes. However, you still have to report your income to the IRS on your tax return using a 1099 form.

How to File Form 1099

A 1099-NEC is used to report nonemployee compensation, such as payments to independent contractors. 1099 forms are federal income tax information forms from businesses and other institutions to document certain financial transactions conducted during a tax year. Internal Revenue Service (IRS) and if required, state tax departments. Copies are also sent to individual taxpayers to help them total their income from various sources and calculate their taxes accurately. This new form will be issued, starting with sales in 2011, by banks and other payment processors, to report gross receipts of payments. So, those who use PayPal, accept credit cards, and sell on eBay will have their income reported, officially by payment processors, to the IRS.

Employees receive a W-2, whereas a 1099 form documents income you earned outside of W-2 earnings. If your long-term care insurance paid out benefits during the year, the insurer will probably file a Form 1099-LTC. If you received payments from the accelerated death benefits of a life insurance policy, those are reported on this form, too.

- To be eligible for this tax benefit, your distributions must be used for qualifying health-related expenses.

- This requirement usually does not apply to corporations receiving payments.[7] See the table in the variants section for specific minimum amounts for each form.

- You’ll also receive one if any foreign taxes were withheld and paid for from your interest income, or if your earned interest was subject to backup withholding.

Finally, you’ll see a section to report state income earned and your company’s state tax identification number. The IRS does not require this information, but many businesses include it to make state income tax filings easier for the contractor. Those who receive 1099s are expected to use them in preparing personal income tax returns, normally due by April 15. Because taxes are not withheld from wages of 1099 workers, they often fail to save enough to pay their income taxes. This form is issued if you received payments exceeding $600 for goods or services via third-party services, such as credit card processors, merchant card services, or even PayPal. Ridesharing drivers will receive a Form 1099-K for gross ride receipts accrued during the tax year, in addition to a Form 1099-MISC.

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. In 2011 the requirement was extended by the Small Business Jobs Act of 2010 to payments made by persons who receive income from rental property. Although the new reporting requirements shift the reporting responsibility from the customers to the merchants and banks, customers may not make the distinction and could report the same transactions twice.

The W-2 reports all money paid to an employee as well as withholdings for taxes and tax-deferred retirement accounts. 1099-NEC forms are used to report payments to freelancers and other independent contractors and generally don’t include withholdings. If you aren’t an employee on a business’ payroll but receive compensation from a business for services, you will receive a 1099-NEC. While those providing services to individuals other than a business do not need to file a 1099-NEC form, note that they still need to report their income when filing self-employed tax returns. You’ll also receive 1099 forms for other types of incomes, including investment transactions, real estate transactions, barter exchange and retirement distributions.